All Categories

Featured

Table of Contents

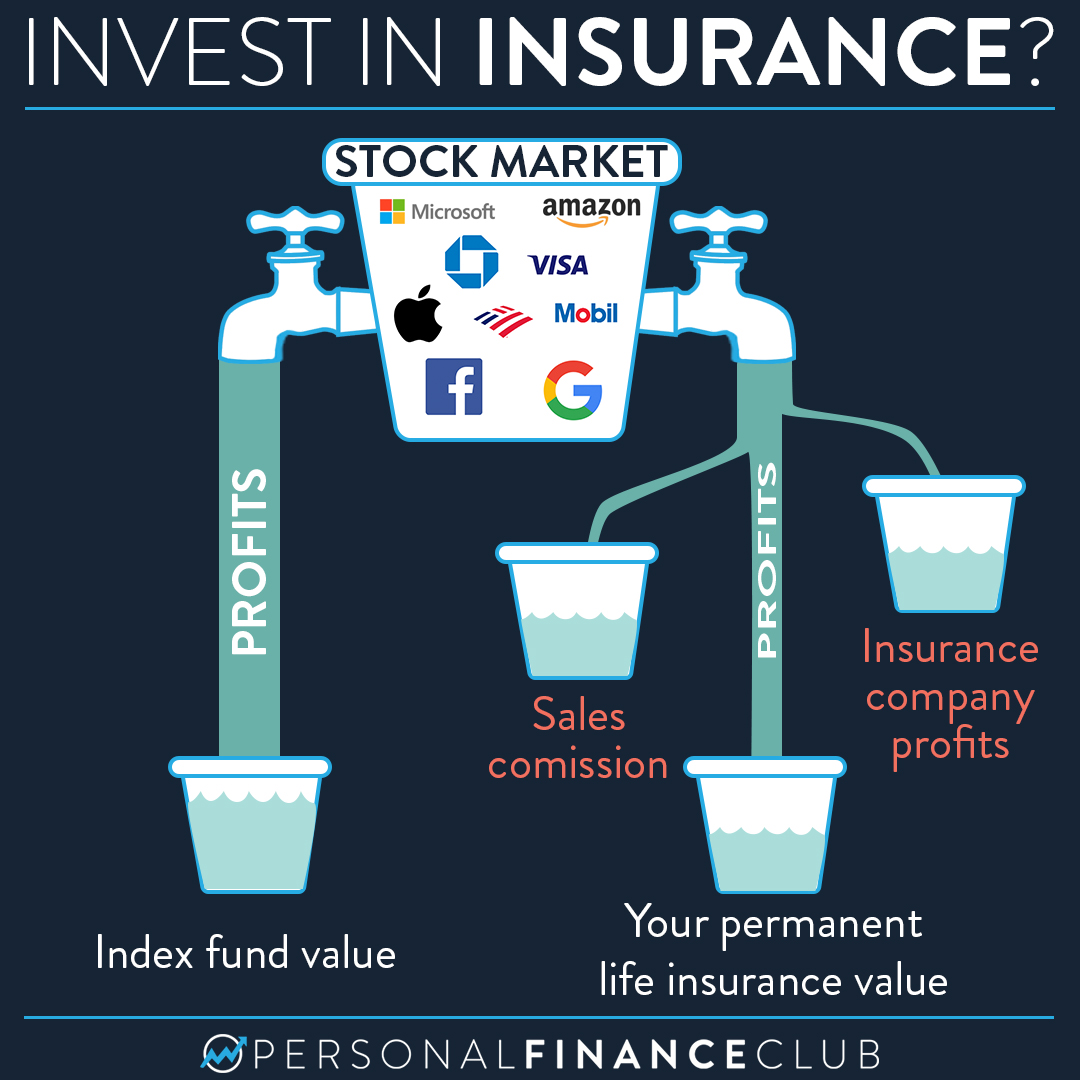

If you're somebody with a reduced tolerance for market variations, this understanding might be invaluable - Indexed Universal Life policyholders. One of the vital aspects of any insurance coverage is its expense. IUL policies often include various costs and costs that can impact their general value. A financial advisor can damage down these costs and assist you consider them versus various other low-priced investment choices.

However don't just think about the premium. Pay specific interest to the plan's attributes which will be very important depending upon exactly how you intend to utilize the policy. Talk with an independent life insurance policy representative who can help you select the best indexed universal life policy for your requirements. Total the life insurance coverage application completely.

Evaluation the policy meticulously. If sufficient, return authorized delivery receipts to get your global life insurance protection in pressure. Make your very first costs repayment to activate your plan. Currently that we've covered the advantages of IUL, it's vital to recognize exactly how it compares to various other life insurance policy policies available on the market.

By understanding the resemblances and differences in between these policies, you can make a more enlightened decision regarding which type of life insurance is best fit for your requirements and financial goals. We'll start by comparing index universal life with term life insurance policy, which is frequently taken into consideration the most uncomplicated and affordable sort of life insurance.

Iul Vs Whole Life

While IUL might give higher potential returns due to its indexed cash worth growth mechanism, it also includes higher premiums compared to term life insurance policy. Both IUL and whole life insurance policy are kinds of long-term life insurance policy policies that supply death benefit security and cash value growth chances (IUL investment). There are some key differences between these 2 types of policies that are essential to think about when deciding which one is appropriate for you.

When considering IUL vs. all other kinds of life insurance policy, it's vital to evaluate the pros and cons of each plan type and seek advice from a skilled life insurance policy representative or financial consultant to identify the very best choice for your special requirements and economic goals. While IUL offers several benefits, it's also vital to be mindful of the risks and considerations connected with this kind of life insurance plan.

Allow's delve deeper right into each of these threats. Among the primary concerns when taking into consideration an IUL plan is the various expenses and costs associated with the policy. These can include the cost of insurance policy, policy fees, surrender charges and any type of additional cyclist prices incurred if you add fringe benefits to the policy.

Some might offer much more competitive rates on protection. Examine the financial investment options offered. You want an IUL plan with a range of index fund choices to satisfy your requirements. Make sure the life insurer aligns with your individual financial goals, requirements, and danger resistance. An IUL plan should fit your certain circumstance.

Why do I need Guaranteed Interest Iul?

Indexed global life insurance coverage can supply a variety of advantages for insurance policy holders, consisting of flexible costs settlements and the potential to gain higher returns. The returns are restricted by caps on gains, and there are no guarantees on the market performance. All in all, IUL policies provide several prospective benefits, yet it is necessary to recognize their threats as well.

Life is not worth it for most individuals. It has the potential for huge investment gains however can be unpredictable and expensive contrasted to typical investing. Additionally, returns on IUL are usually reduced with considerable charges and no assurances - Indexed Universal Life companies. Generally, it depends upon your demands and goals (Indexed Universal Life policy). For those searching for predictable lasting financial savings and ensured survivor benefit, whole life might be the far better option.

Who has the best customer service for Iul Protection Plan?

The advantages of an Indexed Universal Life (IUL) plan include prospective greater returns, no disadvantage risk from market motions, protection, versatile payments, no age demand, tax-free death benefit, and lending availability. An IUL policy is permanent and offers cash worth growth via an equity index account. Universal life insurance policy started in 1979 in the USA of America.

By the end of 1983, all major American life insurance companies offered universal life insurance coverage. In 1997, the life insurance company, Transamerica, introduced indexed universal life insurance policy which gave policyholders the capability to link plan growth with international stock exchange returns. Today, global life, or UL as it is additionally known can be found in a variety of different kinds and is a huge part of the life insurance policy market.

The info supplied in this post is for instructional and educational purposes just and ought to not be understood as financial or financial investment recommendations. While the author has competence in the subject, viewers are advised to speak with a qualified financial consultant before making any type of financial investment decisions or purchasing any type of life insurance policy products.

Who provides the best Tax-advantaged Iul?

As a matter of fact, you may not have thought a lot about exactly how you desire to spend your retired life years, though you most likely recognize that you don't intend to lack money and you wish to keep your current way of living. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text shows up beside the service guy speaking with the camera that checks out "business pension", "social security" and "savings"./ wp-end-tag > In the past, individuals trusted three major incomes in their retired life: a company pension plan, Social Safety and security and whatever they would certainly taken care of to conserve

Fewer employers are using standard pension plans. Even if benefits have not been lowered by the time you retire, Social Protection alone was never meant to be sufficient to pay for the lifestyle you desire and deserve.

Before dedicating to indexed universal life insurance policy, right here are some benefits and drawbacks to think about. If you choose a good indexed universal life insurance policy strategy, you might see your cash money value grow in worth. This is handy because you may be able to gain access to this cash prior to the plan ends.

What is a simple explanation of Indexed Universal Life Plans?

If you can access it beforehand, it may be valuable to factor it right into your. Since indexed universal life insurance policy calls for a particular level of risk, insurance policy companies have a tendency to maintain 6. This sort of strategy also provides. It is still assured, and you can adjust the face quantity and cyclists over time7.

Normally, the insurance company has a vested rate of interest in performing much better than the index11. These are all elements to be taken into consideration when choosing the best type of life insurance for you.

However, considering that this sort of plan is much more complex and has an investment component, it can usually come with higher costs than various other plans like whole life or term life insurance policy - IUL retirement planning. If you do not assume indexed global life insurance is best for you, here are some alternatives to consider: Term life insurance policy is a momentary policy that generally uses protection for 10 to 30 years

Latest Posts

Universal Life Insurance Questions

Best Iul Insurance Companies

Universal Underwriting